Ask These Questions to a Pension Fund Management Software Provider to Choose the Right One for You

- December 02, 2023

- 2 minutes

The arena of pension fund management is one that is characterized by a high level of dynamism and complexity. Given the intricate nature of pension fund management, coupled with the intricate regulatory and risk environments that pension funds operate within, it is crucial that pension fund managers equip themselves with state-of-the-art software to enable them to effectively manage the pension assets of their clients. Navigating the labyrinth of software providers can be daunting, but by asking the right questions, one can identify the most suitable provider for their unique needs.

The first question that should be asked pertains to the flexibility of the software. Pension fund management is not a one-size-fits-all affair. Different pension funds have different characteristics, ranging from fund size to asset allocation strategies, to participant demographics. Therefore, the software should be flexible enough to accommodate the unique needs and characteristics of the fund. This is akin to the Pareto Principle, or the 80/20 rule, in economics, which posits that 80 percent of effects come from 20 percent of causes. In the context of pension fund management software, a small set of core features will likely address a significant proportion of a pension fund’s requirements.

Next, inquire about the software's ease of use. A user-friendly interface that is easy to navigate will save significant time and resources in the long run. Moreover, this will reduce the likelihood of errors that can have serious financial implications. From a historical perspective, one only needs to look at the infamous incident involving Knight Capital in 2012, where a software glitch led to a trading loss of $440 million in just 45 minutes. The incident underscores the importance of not only having software that performs its intended function admirably, but also one that is easy to use, to prevent catastrophic errors.

Another salient question that needs to be posed is related to the software's risk management capabilities. Pension funds operate within a complex risk environment, encompassing a wide array of risks – from market risk, to interest rate risk, to credit risk. The software should ideally have robust risk management capabilities, enabling fund managers to effectively identify, measure, and manage these risks. This concept is a reflection of Modern Portfolio Theory (MPT), which underscores the importance of risk management in investment decision-making.

Furthermore, given the pervasive nature of cyber threats in today's digital age, it is crucial to ask about the software's cybersecurity measures. Pension funds hold a treasure trove of sensitive information, making them a prime target for cybercriminals. Satisfactory answers to this question would include encryption of data, use of firewalls, regular security audits, and a comprehensive disaster recovery plan.

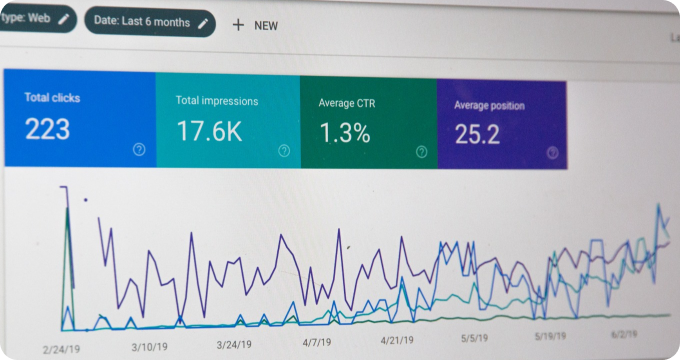

Lastly, inquire about the software's reporting capabilities. The software should be able to generate comprehensive, customized reports that provide insightful analysis on the performance of the pension fund. These reports should be easy to understand and should be readily available at the click of a button. This is a practical manifestation of the field of data science, which emphasizes the importance of data-driven decision-making.

Choosing the right pension fund management software is not a decision to be taken lightly. By asking the right questions, pension fund managers can ensure that they select a software provider that not only meets their current needs, but is also capable of accommodating their future needs.

Learn More

Unleash the potential of your pension fund with the power of technology; dive deeper into our blog posts to discover how pension fund management software can revolutionize your financial future. For an unbiased, comprehensive view, they are encouraged to explore our meticulously curated rankings of the Best Pension Fund Management Software.

Popular Posts

-

8 Compelling Reasons Why You Need Pension Fund Management Software

8 Compelling Reasons Why You Need Pension Fund Management Software

-

Debunking 10 Myths Surrounding Pension Fund Management Software

Debunking 10 Myths Surrounding Pension Fund Management Software

-

5 Things I Wish I'd Known About Pension Fund Management Software Before Implementing One

5 Things I Wish I'd Known About Pension Fund Management Software Before Implementing One

-

How to Hire the Right Pension Fund Management Software Provider

How to Hire the Right Pension Fund Management Software Provider

-

Ask These Questions to a Pension Fund Management Software Provider to Choose the Right One for You

Ask These Questions to a Pension Fund Management Software Provider to Choose the Right One for You