8 Compelling Reasons Why You Need Pension Fund Management Software

- December 23, 2023

- 2 minutes

Entering the labyrinth of pension fund management, especially in an era of increasingly complex financial systems, can be an intimidating process. Yet, with the aid of modern technology, the once arduous task can be rendered virtually effortless. This is where the integration of pension fund management software becomes compellingly unavoidable. As someone who has navigated the intricacies of this field, I present to you eight compelling reasons why pension management software is an essential tool for modern finance.

Firstly, let's define pension fund management software. It is a technological tool designed to aid in the administration, tracking, reporting and analysis of pension funds. This includes the management of investments, contributions, distributions and other essential elements of pension fund management. The relevance of this software is underscored by the fact that it provides a central repository of data, allowing for streamlined operations and enhanced accuracy.

Now let's delve into the reasons why you need this revolutionary tool.

-

Efficiency: Pension fund management software automates repetitive tasks and eliminates the room for human error. It saves time and resources and increases productivity by streamlining the entire management process. Remember the days when the fair value of investments had to be manually computed? Those days are long gone with automated computations and real-time updates.

-

Accuracy: With the automation of tasks comes increased accuracy. The software ensures precision and consistency in performing tasks like computations of benefits, tracking of investments and contributions. This minimizes the risk of costly errors and mitigates the need for frequent audits.

-

Compliance: The world of pension funds is intricately connected with a web of regulatory laws and standards. Keeping up with these ever-evolving regulations can be a daunting task. Pension fund management software, however, is designed to be regulatory-compliant, ensuring your fund stays within the confines of local and international laws.

-

Security: In an increasingly digital world, data security is paramount. Pension fund management software provides top-notch security, safeguarding sensitive data from potential cyber-attacks and data breaches. This level of security can be further enhanced via regular software updates.

-

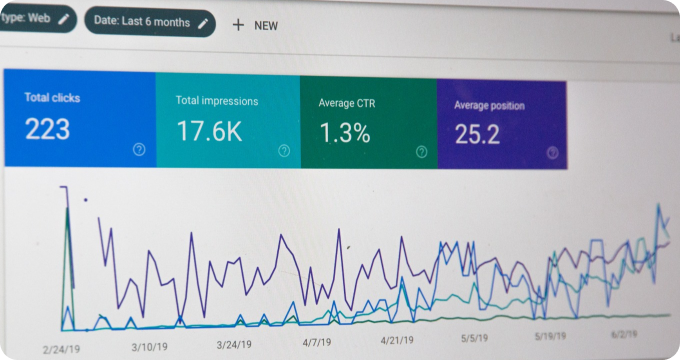

Transparency: The software provides a transparent, real-time overview of the pension funds, allowing for immediate access to information. This transparency facilitates informed decision-making, enhances accountability and fosters trust among stakeholders.

-

Scalability: As your fund grows, so does the complexity of managing it. Pension fund management software is scalable to accommodate this growth. It can handle increasing data volumes and complex transactions, ensuring that the quality of fund management remains uncompromised.

-

Integration: The software can seamlessly integrate with other systems such as CRM, HRM, and accounting software. This integration provides a comprehensive platform for managing all aspects of pension funds.

-

Cost-effectiveness: While the initial investment in pension fund management software might seem high, the long-term benefits far outweigh the costs. Through automation of tasks, reduction of errors, and improved efficiency, the software significantly reduces operational costs.

In conclusion, pension fund management software stands as a beacon of modernization in the complex world of pension fund management. It embodies the principle of Occam's razor, positing that the simplest solution is often the best. With its unprecedented efficiency, accuracy, and transparency, this technological tool offers the simplest and most effective solution to the complexities of pension fund management.

In the words of Albert Einstein, "In the middle of difficulty lies opportunity." And indeed, in the midst of the complexities of pension fund management, pension fund management software presents an opportunity to revolutionize the pension industry. Embrace it, leverage it, and witness the transformation.

Learn More

Unleash the power of your pension fund by diving deeper into our blog posts, where we unravel the complexities of pension fund management software. For an unbiased, comprehensive view, the reader is encouraged to explore our meticulously curated rankings of the Best Pension Fund Management Software.

Popular Posts

-

8 Compelling Reasons Why You Need Pension Fund Management Software

8 Compelling Reasons Why You Need Pension Fund Management Software

-

Debunking 10 Myths Surrounding Pension Fund Management Software

Debunking 10 Myths Surrounding Pension Fund Management Software

-

5 Things I Wish I'd Known About Pension Fund Management Software Before Implementing One

5 Things I Wish I'd Known About Pension Fund Management Software Before Implementing One

-

How to Hire the Right Pension Fund Management Software Provider

How to Hire the Right Pension Fund Management Software Provider

-

Ask These Questions to a Pension Fund Management Software Provider to Choose the Right One for You

Ask These Questions to a Pension Fund Management Software Provider to Choose the Right One for You