4 Essential Questions to Ask Your Pension Fund Management Software Provider

- October 21, 2023

- 2 minutes

The pension fund management landscape is increasingly complex, marked by increased regulatory scrutiny, the proliferation of more sophisticated investment strategies, and the heightened need for transparency and risk management. As a result, pension funds are increasingly turning to specialized management software to address these challenges. In this context, choosing the right pension fund management software is a critical decision that can have far-reaching implications for the performance and risk profile of a pension fund.

When selecting a pension fund management software provider, there are four essential questions to consider:

- How does the software handle asset allocation and risk management?

- What kind of reporting capabilities does the software offer?

- How adaptable is the software to future regulatory changes?

- How does the software provider handle data security and privacy?

The ability to manage asset allocation and risk effectively is crucial in the pension fund management process. The software should have robust functionality in this area, allowing for the construction of diversified portfolios that align with the fund's risk tolerance and investment objectives.

Additionally, it should include advanced analytics that allow for the assessment of various risk factors and their potential impact on the fund's performance. For instance, it may incorporate Monte Carlo simulations, a computational algorithm that relies on repeated random sampling to estimate the probability distribution of an uncertain outcome.

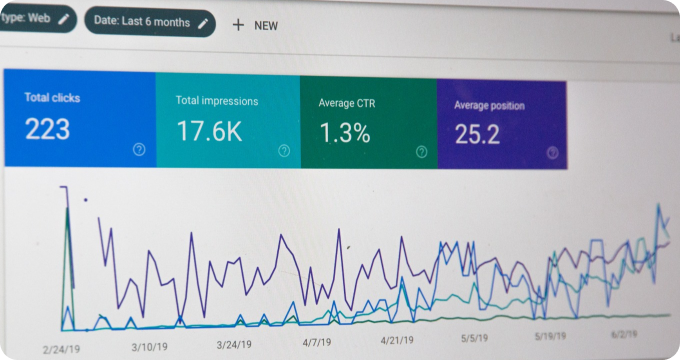

Reporting is another critical component of pension fund management. The software should offer comprehensive reporting capabilities, providing detailed insights into the fund's performance, risk exposures, and compliance with investment guidelines and regulatory requirements. For instance, it should be capable of generating reports on the Sharpe ratio, a measure used to understand the return of an investment compared to its risk, to help assess portfolio performance.

The regulatory environment for pension funds is continually evolving, and the software should be adaptable to these changes. A good software provider will have a strong understanding of the regulatory landscape and will regularly update the software to reflect new regulations. For instance, they should be able to navigate the intricacies of laws such as the Employee Retirement Income Security Act (ERISA), which sets minimum standards for pension plans in private industry.

Finally, data security and privacy are paramount, given the sensitive nature of the information managed by pension funds. The software provider should have robust security measures in place to protect data from potential breaches. This might include encryption technologies, secure user authentication protocols, and regular vulnerability assessments.

It's also worth noting the trade-offs associated with different types of software. For instance, cloud-based software provides the benefits of scalability and cost-effectiveness, but may have limitations in terms of customization and may raise additional data security concerns. On the other hand, on-premise solutions offer greater control and customization, but may require more substantial upfront investment and ongoing maintenance costs.

Choosing the right pension fund management software is a complex decision that requires a careful assessment of the fund's needs and the capabilities of different software providers. By asking these essential questions, pension funds can ensure they select a software provider that will help them navigate the complex landscape of pension fund management, and ultimately, deliver superior outcomes for their members.

Learn More

Unlock the secrets to a secure financial future by diving deeper into our enlightening blog posts on pension fund management software. For an unbiased, comprehensive view, they are encouraged to explore our meticulously curated rankings of the Best Pension Fund Management Software.

Popular Posts

-

8 Compelling Reasons Why You Need Pension Fund Management Software

8 Compelling Reasons Why You Need Pension Fund Management Software

-

Debunking 10 Myths Surrounding Pension Fund Management Software

Debunking 10 Myths Surrounding Pension Fund Management Software

-

5 Things I Wish I'd Known About Pension Fund Management Software Before Implementing One

5 Things I Wish I'd Known About Pension Fund Management Software Before Implementing One

-

How to Hire the Right Pension Fund Management Software Provider

How to Hire the Right Pension Fund Management Software Provider

-

Ask These Questions to a Pension Fund Management Software Provider to Choose the Right One for You

Ask These Questions to a Pension Fund Management Software Provider to Choose the Right One for You